Effective Financial document management is crucial for financial institutions, given the sensitive nature of the data they handle and the stringent regulatory requirements they must comply with. Implementing robust document management guidelines can help ensure compliance, enhance security, and improve operational efficiency. Here are our top ten best practices for managing records in the financial services sector:

1. Establish a Comprehensive Document Management Policy

A well-defined document management policy is the foundation of effective Financial document management. This policy should outline the types of records to be maintained, retention periods, and procedures for secure financial document storage and destruction. Ensure that the policy is regularly reviewed and updated to reflect changes in regulations and business needs.

2. Implement a Retention Schedule

Develop a retention schedule that specifies how long different types of records should be kept. This schedule should be based on legal, regulatory, and business requirements. Regularly review and update the retention schedule to ensure it remains compliant with current laws and regulations.

3. Digitise Records

Transitioning from paper to digital records can significantly enhance efficiency and security. Document digitisation allows for easier access, better organisation, and more secure storage of records. Ensure that all digital records are properly indexed and stored in a secure, centralised system.

4. Ensure Data Security

Data security is paramount in the financial services sector. Implement robust security measures to protect both paper and digital records. This includes encryption, secure storage solutions, access controls, and regular security audits. Ensure that all employees are trained on data security best practices.

5. Regularly Audit Records

Conduct regular audits of your records management system to ensure compliance with your policy and retention schedule. Audits can help identify any gaps or areas for improvement in your document management practices.

6. Train Employees

Provide regular training for employees on document management policies and procedures. Ensure that all staff understand the importance of proper document management and are aware of their responsibilities. Training should cover topics such as data security, retention schedules, and procedures for handling sensitive information.

7. Implement Access Controls

Restrict access to sensitive records to authorised personnel only. Implement access controls to ensure that only those who need to access certain records can do so. This helps protect sensitive information and reduces the risk of data breaches.

8. Use Secure Destruction Methods

When records reach the end of their retention period, ensure they are destroyed securely. For paper records, use shredding services that comply with industry standards. For digital records, use secure deletion methods that ensure data cannot be recovered.

9. Monitor Regulatory Changes

Stay informed about changes in regulations that affect document management in the financial services sector. Regularly review and update your document management policies and procedures to ensure compliance with new laws and regulations.

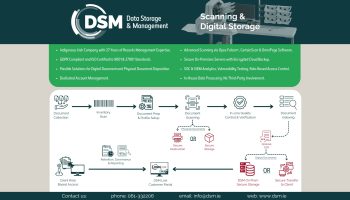

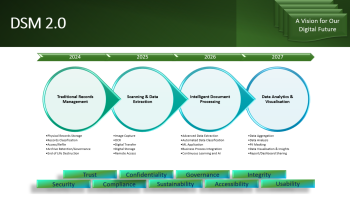

10. Leverage Technology

Utilise document management software to automate and streamline your document management processes. Technology can help with indexing, tracking, and securely storing records, as well as ensuring compliance with retention schedules and regulatory requirements.

By following these best practices, financial institutions can ensure that their document management processes are efficient, secure, and compliant with regulatory requirements. Effective document storage and management not only helps protect sensitive information but also enhances operational efficiency and reduces risks.

To learn more about how DSM can help you implement these best practices, contact us today. Our experts are here to assist you in developing a robust document management strategy tailored to your needs.